Strategies for Responsible Investing Amidst Market Downturns

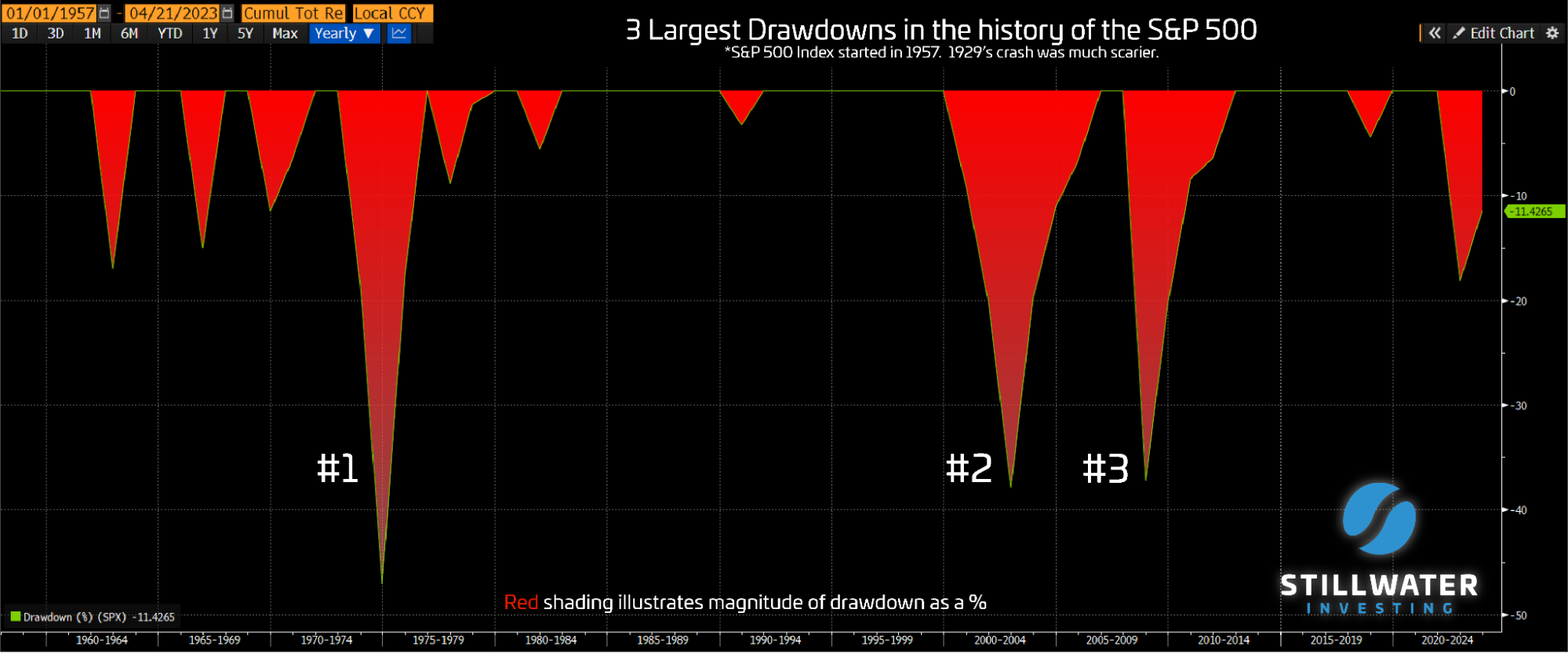

Analyzing the S&P 500's Largest Drawdowns Since 1957

This article offers key information for investors so they can have an in-depth understanding of market trends and risks. It does so by exploring the three largest drops in the history of the S&P 500 Index for lessons to improve investor strategies moving forward. Fluctuations have been a regular part of free markets. The broad market goes up and DOWN, sometimes sharply.

1: The Nixon Drawdown (1973-1980)

Between January 11, 1973, and July 17, 1980, the S&P 500 experienced a turbulent period marked by a confluence of challenging events.

The Vietnam War, which spanned from the mid-1960s to 1975, led to increased government spending and economic uncertainty. As a result, in 1971, President Nixon took the United States off the gold standard to address budget deficits. As a consequence, inflation skyrocketed, and global confidence in the dollar waned.

On top of that, in response to the U.S.'s support of Israel during the Yom Kippur War in 1973, The OPEC (Organization of Petroleum Exporting Countries) imposed an oil embargo on the U.S. This resulted in a severe oil shortage and soaring oil prices.

2: The Tech Wreck (2000-2002)

The second-largest drop in the S&P 500's history took place during the Dot-Com Bubble Burst, which occurred from 2000 to 2002. The index declined by approximately 47.2% as investor confidence in technology stocks waned. This period was marked by the rapid rise and subsequent fall of internet-based companies, many of which were overvalued and lacked sustainable business models. When the bubble burst, numerous tech companies went bankrupt or faced severe financial difficulties.

3: The Global Financial Crisis (2007-2009)

The most significant drop in the S&P 500's history occurred during the Global Financial Crisis, which began in late 2007 and lasted until early 2009. The index lost approximately 55% of its value during this time. The primary cause of this decline was the collapse of the US housing market. As mortgage-backed securities lost value, financial institutions faced a liquidity crisis, leading to government bailouts and massive layoffs. The crisis spread globally, causing stock markets around the world to plummet.

Some lessons we have learned from downturns:

• It hasn’t paid to bet against America

• Despite experiencing numerous downturns since its inception in 1957, America, and the representative S&P 500, has consistently demonstrated resilience and long-term growth for investors. As of April 2023, the S&P 500 index has delivered an average annualized total return of 10.2%. (chart above).

• Downturns are a natural part of market cycles

• Understanding that market downturns are normal and expected events can help investors maintain perspective during times of financial stress. They can occur as a result of economic factors, geopolitical events, or shifts in investor sentiment.

• Market timing is difficult

• Predicting the exact start and end of downturns is notoriously difficult. Instead of trying to time the market, focus on building a diversified and well-balanced portfolio that can weather market fluctuations.

• Dollar-cost averaging can be beneficial

• Dollar cost averaging can be particularly useful for people who are still working and cannot yet rely on their investment account as a primary source of income. By investing small amounts at a steady interval, investors can potentially spread out risk and reduce the impact of volatility on their investment returns. Dollar cost averaging can help people stay disciplined in their investment strategy by automating regular investments. Auto pay is one of our favorite tools.

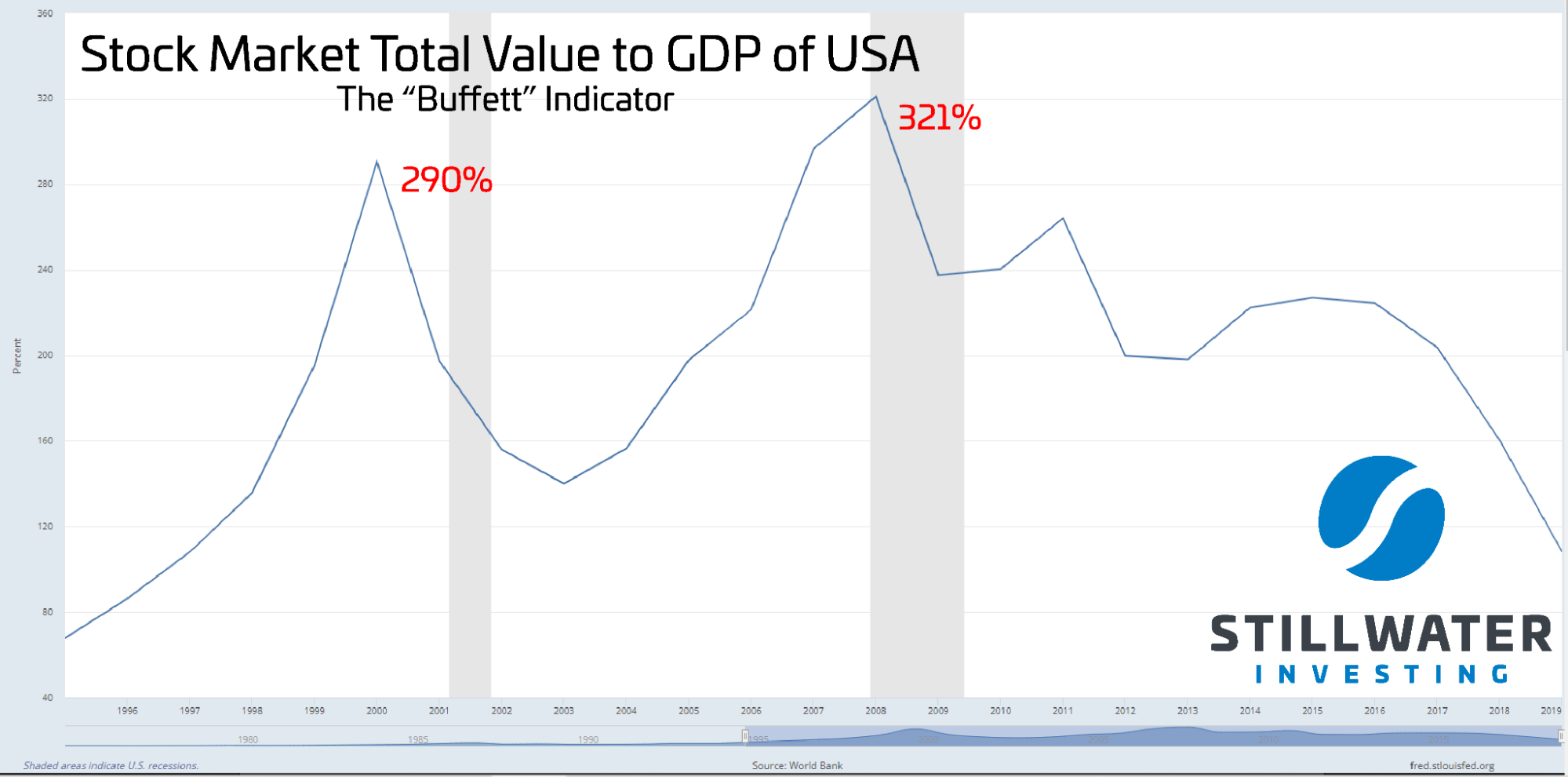

• Valuation matters

• Downturns can provide opportunities to invest in fundamentally strong companies at lower valuations. Identifying and investing in such companies during a downturn can result in significant gains once the market recovers.

• Maintain an emergency fund

• Having plenty of cash reserves set aside for emergencies can help you avoid the need to sell investments at a loss during downturns. Save some “dry powder” to buy from pessimistic sellers fleeing for the hills.

• Embrace the learning opportunities

• Downturns can be excellent learning experiences for investors. They can help you refine your investment strategy, identify your risk tolerance, and better understand the nature of financial markets. Reflecting on past downturns can also help you prepare for and navigate future market challenges.