Inflation

3/21/2022

Inflation is a tax by the U.S. government on holders of United States dollar (USD). Inflation is very hard to measure and predict. I write this article to help prepare my fellow Americans for lives with inflation. I won’t be able to give you specific numbers. I don’t know them. I do know the value of the dollar is diminishing and why. The important part is you adapt to the environment and change plans to live in the inflationary environment we find ourselves in. To survive in this world we must be adaptive. It’s our best traits as humans.

How do we adapt to inflation? The first step is baking it into the cake. When do we need to consider inflationary forces?

1: When negotiating for wages.

2: When and how to set prices for our customers.

3: When determining how customers pay.

4: Whenever taking or giving a loan.

A: Duration (length of loan) changes everything.

5: When determining which assets to store wealth in.

We’ll go over the basics here. If you’d like to delve deeper, please contact us. The USD is a fiat currency that is backed essentially by the value of the U.S. governmental infrastructure, property, and ability to tax American citizens and businesses. The U.S. government does have substantial gold holdings, but those aren’t explicitly tied to the currency. The value of the currency is determined by supply and demand.

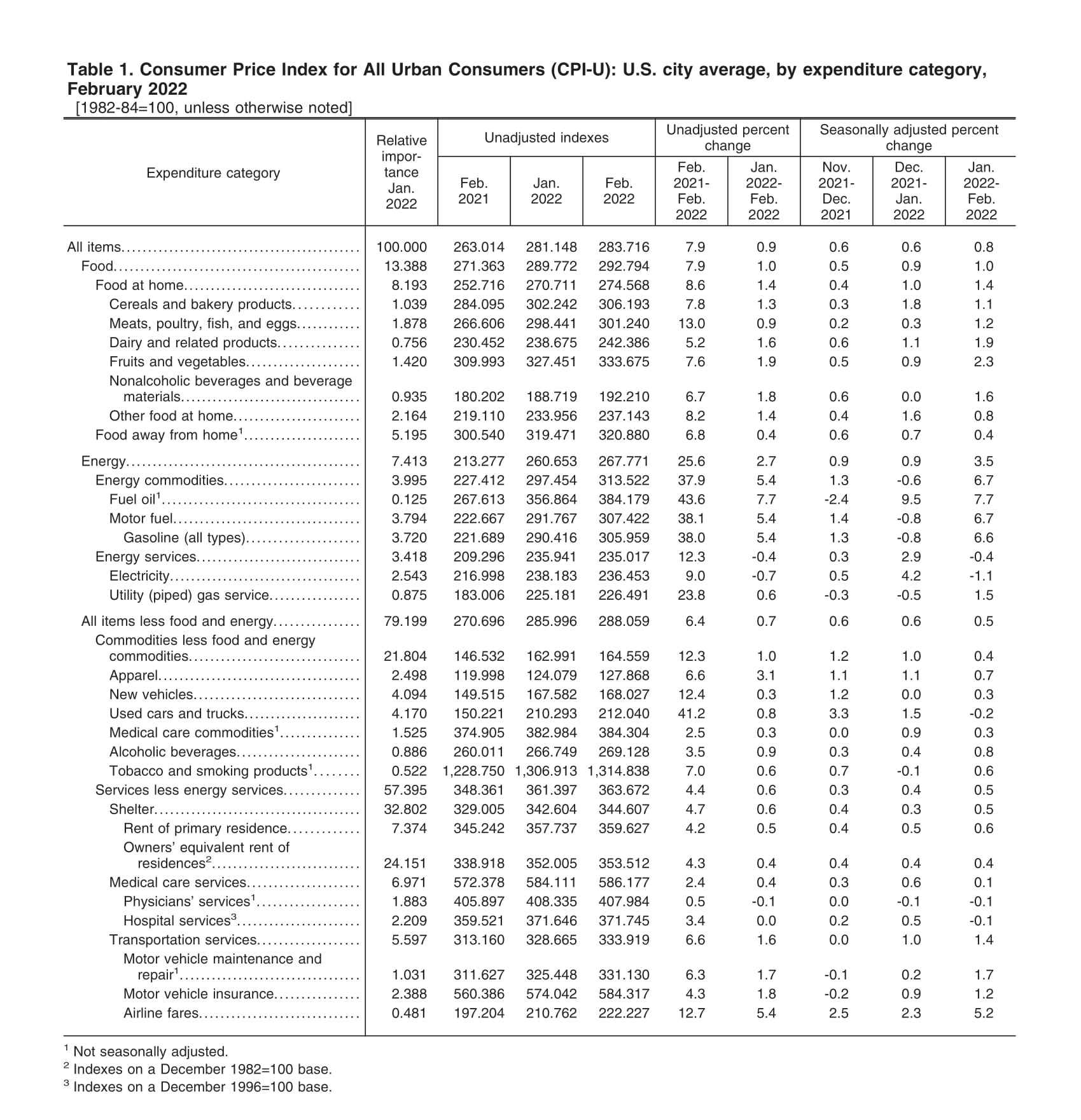

Even measuring inflation is difficult. The Consumer Price Index (CPI) consists of a basket of goods of an “average urban consumer” in the USA. It looks something like this:

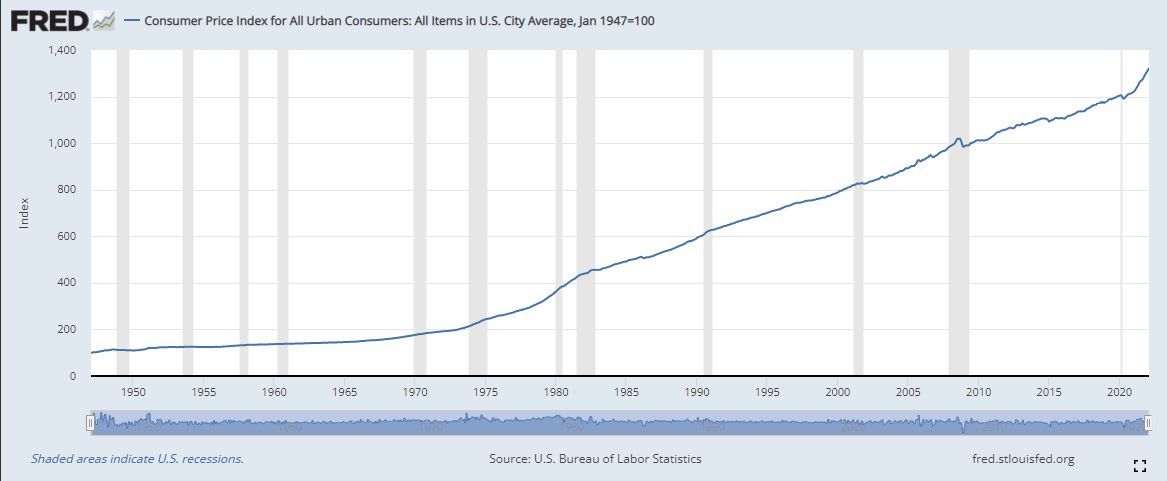

Here is the CPI indexed to 1947 dollars. This is saying you’d need $1312 in today's dollars to buy what $100 would’ve gotten you in 1947. If you’re living off wages and they don’t match the rate of inflation, your actual buying/saving power has decreased. Knowledge = power.

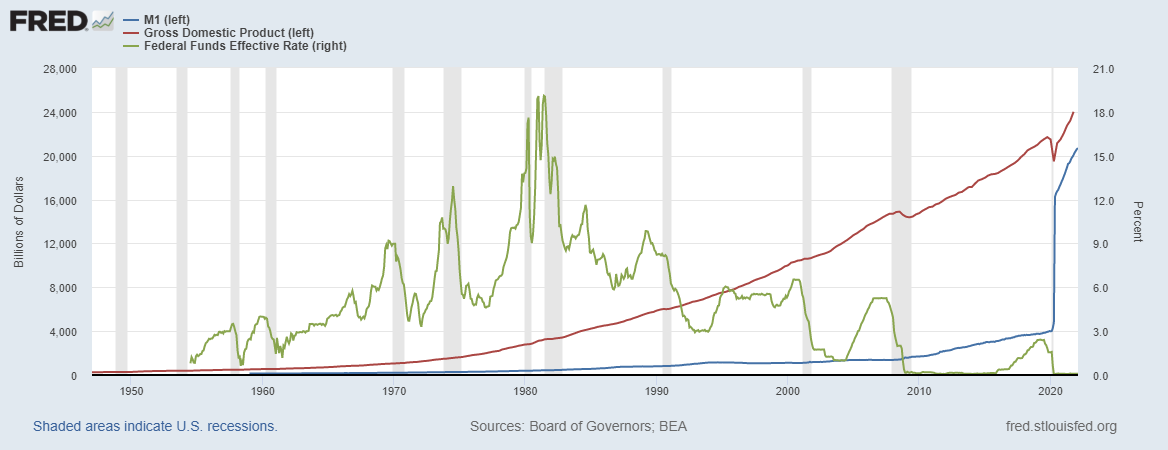

Finally I’ll conclude with my expectations for inflation: lots. Inflation has lots of factors impacting it. Factors to look at:

1: Supply of money: There are many different ways to count money (See the Fed’s explanation on money counts here). M1 is considered “near” or a narrow way to count the money supply. M1 consists of:

A: “Hard” currency

B: Demand, liquid, and savings deposits.

C: Doesn’t include any financial assets (no bonds for example).

2: Gross domestic product (GDP) is the total value of all finished goods and services produced by the USA.

3: Effective Federal Funds Rate: This is set by a quasi-government agency known as the Federal Reserve (Fed). It targets the amount banks charge each other to borrow money from each other.

This chart shows so much of the action and goals of the Fed. The Fed classically used its federal funds rate to balance out price stability and “full” employment. Basically it would lower rates to spur the economy (think alcoholic punch bowl at a party), and raise rates to combat inflation. High interest rates reduce lending and therefore consumption/consumer spending. You can see Paul Volcker (Fed president 1979-1987) getting serious about inflation in the late 70’s. I don’t believe we’ll see that kind of action out of current chairman Jerome Powell (Fed president 2018-present).

Powell has shown little stomach for recession or any other action unpopular with the masses. I think you can see that in the COVID response. Monetary policy (controlled by the Fed) and fiscal policy (controlled by Congress and the president) combined response was never seen before. They printed, gave away, and spent 16 trillion dollars. It’s quite a feat to even print 16 trillion dollars in a year. If you stacked up that many $1 bills, it’d be over a million miles high.

In conclusion, inflation is hard to measure precisely. It’s hard to know the expected lag from printing to inflation because of the multitude of factors involved. What we do know is the U.S. government responded to COVID with unprecedented money printing. It takes a strong leader to effectively combat inflation at current levels. The federal funds rate will probably need to be raised (increasing borrowing costs for consumers) and the subsequent economic pain will have to be withstood. Think of stimulus as a credit card. It’s super fun while spending, but equal/more painful when paying back. We believe substantial inflation will continue, so plan accordingly. Schedule an appointment for help anytime.